Discover the Advantages of Federal Credit Report Unions

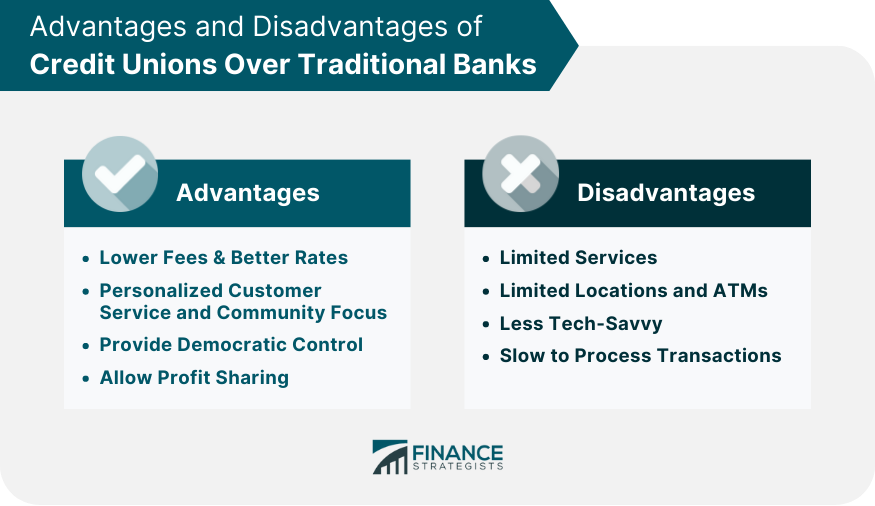

Federal cooperative credit union supply a wealth of benefits that deal with the needs of their members in a manner that typical financial institutions commonly ignore. From competitive interest rates to tailored customer care, the advantages of becoming part of a government debt union go past just monetary purchases. These institutions focus on member satisfaction and area involvement, developing an one-of-a-kind banking experience that places people first. By exploring the benefits of government credit scores unions, you might discover a monetary landscape that lines up more closely with your values and objectives.

Membership Advantages

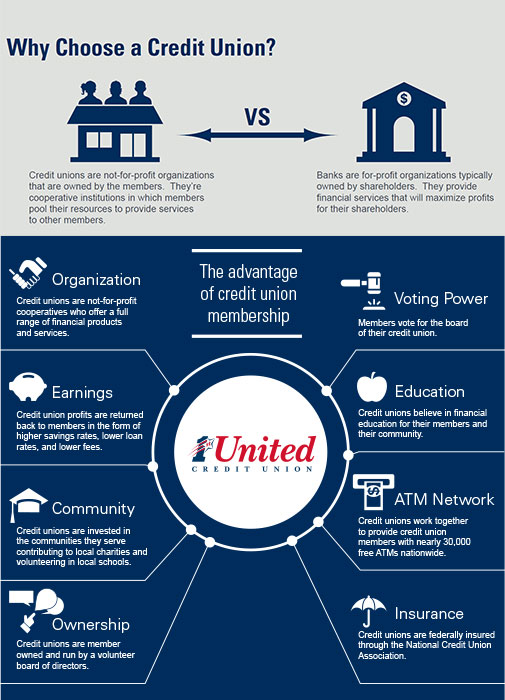

An additional considerable advantage of subscription in a federal lending institution is the possibility to join decision-making procedures. Unlike banks, lending institution run as not-for-profit companies had by their participants. This democratic structure enables participants to elect on important concerns and choose the board of directors, making certain that the lending institution remains responsible to the neighborhood it offers.

Lower Prices and fees

Federal credit report unions are understood for their competitive prices on financings, credit cards, and savings accounts. In addition, credit scores unions are not-for-profit organizations, indicating they focus on serving their members instead than taking full advantage of revenues. Overall, the reduced prices and fees given by federal credit report unions add to a more affordable and financially helpful financial experience for their participants.

Personalized Financial Providers

How do credit report unions distinguish themselves by offering personalized financial services tailored to specific member requirements? Federal credit scores unions succeed in this element by focusing on the one-of-a-kind demands of each participant.

Customized economic services at lending institution expand beyond just fundamental banking demands (Credit Unions Cheyenne). Members can access tailored investment suggestions, insurance policy products, and also estate preparation services. This individualized method produces a sense of count on and loyalty between participants and their cooperative credit union, promoting lasting connections improved good understanding and assistance

Neighborhood Involvement Opportunities

Involving with local neighborhoods, cooperative Recommended Reading credit union give diverse opportunities for participants to proactively join different community participation efforts. These efforts can vary from offering at local events, organizing charity drives, taking part in financial literacy programs, to sustaining local services. By actively taking part in area involvement chances, credit history union members not only add to the betterment of their communities yet likewise foster strong connections with other community members.

One considerable facet of neighborhood participation via lending institution is the focus on economic education. Cooperative go to website credit union typically conduct workshops and seminars on numerous economic topics, such as budgeting, saving, and investing, to equip members with the expertise to make audio monetary decisions. Furthermore, lending institution regularly collaborate with neighborhood schools and companies to promote monetary proficiency amongst students and young grownups.

Access to Nationwide ATM Networks

Access to Nationwide Atm Machine Networks is an essential advantage offered by federal lending institution, supplying members with practical access to a vast network of Atm machines across the country. This advantage makes certain that participants can quickly access money and perform purchases wherever they may be, whether they are traveling for company or enjoyment. Federal credit rating unions typically take part in nationwide ATM networks such as CO-OP Network, Allpoint, or MoneyPass, enabling their participants to make use of hundreds of ATMs without sustaining added costs.

Conclusion

To conclude, government lending institution supply browse this site members numerous advantages, including affordable rates of interest, lower fees, customized monetary services, and opportunities for neighborhood involvement - Credit Unions Cheyenne. By prioritizing participant needs over profits, credit scores unions supply a distinct and customized method to economic solutions. With accessibility to nationwide atm machine networks and autonomous decision-making procedures, participants can profit from a community-oriented and customer-focused economic institution

One crucial advantage of being a participant of a government credit rating union is accessibility to affordable passion rates on cost savings accounts, finances, and credit scores cards. Federal credit scores unions are understood for their competitive rates on finances, debt cards, and financial savings accounts. By proactively engaging in community involvement opportunities, credit rating union participants not only contribute to the improvement of their communities but likewise foster strong partnerships with other neighborhood members.

Credit report unions often conduct workshops and workshops on various monetary subjects, such as budgeting, conserving, and investing, to empower members with the understanding to make audio financial choices.In final thought, government credit scores unions supply members different advantages, consisting of affordable rate of interest rates, lower charges, individualized monetary solutions, and opportunities for neighborhood participation.